how much taxes are taken out of paycheck in michigan

Michigan Michigan Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. How do I calculate how much tax is taken out of my paycheck.

Your average tax rate is 1198 and your marginal tax rate is 22.

. Taxes are paid at 6 for the initial 7000 of each employees wages each year. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The median household income is 54909 2017.

Overview of Michigan Taxes. The tax rate for 2022 is 425. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator.

So you wont get a tax withholding break from supplemental wages in Michigan. Amount taken out of an average biweekly paycheck. I have Michigan employees but my company is located in.

How much do you make after taxes in Michigan. Form 446 Income Tax Withholding Guide. Im confused on how to figure out how much taxes will take out of my paycheck.

Supports hourly salary income and multiple pay frequencies. Total income taxes paid. For 2022 employees will pay 62 in Social Security on the first 147000 of wages.

Use this paycheck calculator to figure out your take-home pay as an hourly employee in Michigan. Michiganian only need to pay federal income tax and a flat state-level income tax rate of 425. Total income taxes paid.

Amount taken out of an average biweekly paycheck. Filing and paying Federal payroll taxes Depending on how much you owe send the withheld taxes and your portion of. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income.

In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same flat rate of 425. This marginal tax rate means that. Michigan is a flat-tax state that levies a state income tax of 425.

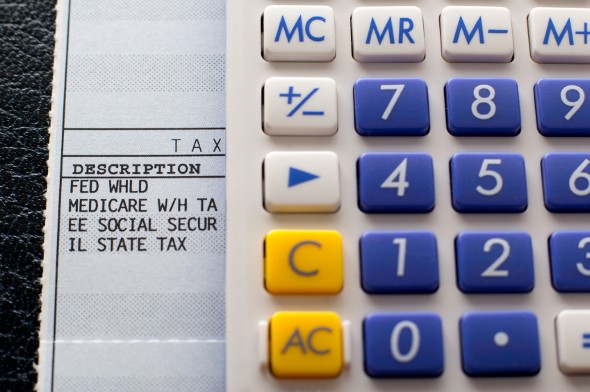

This differs from some states which tax supplemental wages at a different rate. Overview of Michigan Taxes Gross Paycheck 3146 Federal Income 1532 482 State Income 507 159 Local Income 350 110 FICA and State Insurance Taxes 780. FICA taxes consist of Social Security and Medicare taxes.

Federal income taxes are paid in tiers. For a single filer the first 9875 you earn is taxed at 10. Total income taxes paid.

However they dont include all taxes related to payroll. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. The Medicare tax rate is 145.

What is Michigans 2021 payroll withholding tax rate. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis. 8 New or Improved Tax Credits and Breaks for Your 2020 Return.

Hey so Im 16 years old and Im hoping to get a job soon in Michigan. The take home pay is 4259950 for a single resident in Detroit with an annual income of 55000. For a married couple with a combined annual income of 110000 the take home pay is 85199.

The next 30249 you earn--the amount from 9876 to 40125-. If a taxpayer claims one withholding allowance 4150 will be withheld per year for federal income taxes. Switch to Michigan hourly calculator.

FICA taxes are commonly called the payroll tax. What is Michigans 2021 personal exemption amount. Where can I get more information about Michigan income tax.

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax rate. For a single taxpayer a 1000 biweekly check means an annual gross income of 26000. If you make 70000 a year living in the region of Michigan USA you will be taxed 11154.

Federal credits can reduce the rate you pay down to 06. Calculates Federal FICA Medicare and withholding taxes for all 50 states. The personal exemption amount for 2022 is 5000.

The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim. The amount withheld per paycheck. 8 New or Improved Tax Credits and Breaks for Your 2020 Return.

These amounts are paid by both employees and employers. Press J to jump to the feed. Local income tax rates top out at 240 in Detroit.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

What Are Marriage Penalties And Bonuses Tax Policy Center

How Much Does A Small Business Pay In Taxes

Should You Move To A State With No Income Tax Forbes Advisor

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

2022 Federal State Payroll Tax Rates For Employers

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Does The Deduction For State And Local Taxes Work Tax Policy Center

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Paycheck Taxes Federal State Local Withholding H R Block

Tax Burden By State 2022 State And Local Taxes Tax Foundation

2022 Federal Payroll Tax Rates Abacus Payroll

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Online Taxes Tax Refund

Former Carson S In Rochester Hills To Become Von Maur Rochester Hills Village Pacific Grove California

2021 Federal Payroll Tax Rates Abacus Payroll

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Many People Live Paycheck To Paycheck And Missing Any Time Because Of A Workplace Accident Can Result I Paying Taxes Worker Social Security Disability Benefits