san francisco county sales tax rate

California documentary and property transfer tax rates. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Sales Gas Taxes Increasing In The Bay Area And California

The minimum combined 2022 sales tax rate for San Francisco California is.

. The minimum combined sales tax rate for San Francisco California is 85. San Francisco County has one of the higher property tax rates in the state at around 1176. The 2018 United States Supreme Court decision in South Dakota v.

You can find more tax rates and allowances for San Francisco County. 1788 rows San Francisco 8625. Actual property tax rates vary slightly from property to property within cities and counties due to special property tax boundaries.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. This is the total of state county and city sales tax rates. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

In San Francisco the tax rate will rise from 85 to 8625. Those district tax rates range from 010 to 100. San Francisco County collects on average 055 of a propertys assessed fair market value as property tax.

What Is The Sales Tax In San Francisco. The County sales tax rate is 025. Has impacted many state nexus laws and sales tax collection requirements.

This is the total of state county and city sales tax rates. The San Francisco County Sales Tax is 025. The thing to note however is that rates have been climbing everywhere.

Did South Dakota v. San Francisco County CA Sales Tax Rate. The California sales tax rate is currently 6.

Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625. San Francisco County has one of the highest median property taxes in the United States and is ranked 52nd of the 3143 counties in order of median. The San Francisco sales tax rate is.

As many others have pointed out San Francisco is not even close. San jose sales tax rate history property tax information san antonio. Solution The minimum combined sales tax rate for San Francisco California is 85.

The current total local sales tax rate in San Francisco CA is 8625. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The December 2020 total local sales tax.

The current total local sales tax rate in San Francisco County CA is 8625. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. The December 2020 total local sales tax rate was 8500.

2015 santa clara county sales tax rate  taxes. The County sales tax rate is 025. Hotel room tax sf controller.

For major cities Google seems to think Long Beach CA and Chicago are the highest at over 10. To review the rules in California visit our state-by-state guide. San Francisco CA Sales Tax Rate.

A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax. Answer 1 of 11. Some areas may have more than one district tax in effect.

The California sales tax rate is currently 6. San Juan Bautista 9000. What is the sales tax rate in San Francisco California.

San jose ca home prices amp home values zillow. There is no applicable city tax. CA Sales Tax Rate.

Most of these tax changes were approved by voters. Singapore sales tax rate gst 2006 2018 data chart. The County sales tax rate is.

The statewide tax rate is 725. This is the total of state county and city sales tax rates. San Juan Plaza San Juan.

San jose demographics and diversity san jose. 1 counties have higher tax rates. The San Francisco County sales tax rate is.

What is the sales tax in San Francisco 2020. The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. 56 out of 58 counties have lower property tax rates.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. The Sales and Use tax is rising across California including in San Francisco County. The California sales tax rate is currently.

San Juan Capistrano 7750. Note that 1176 is an effective tax rate estimate. The San Francisco sales tax rate is.

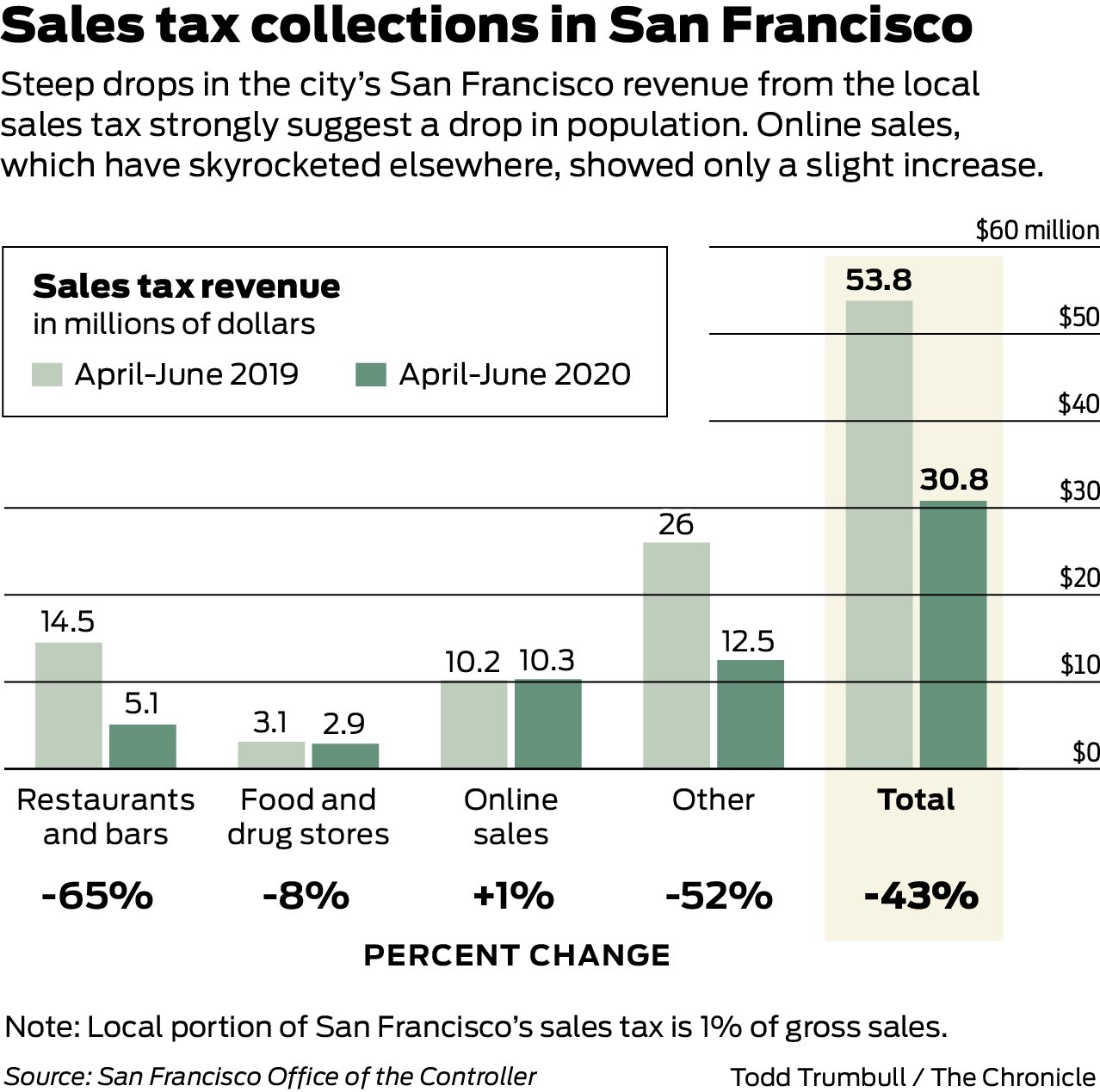

Yes People Are Leaving San Francisco After Decades Of Growth Is The City On The Decline

Understanding California S Sales Tax

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

How Do State And Local Sales Taxes Work Tax Policy Center

California Sales Tax Guide For Businesses

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Understanding California S Sales Tax

Understanding Where California S Marijuana Tax Money Goes

Frequently Asked Questions City Of Redwood City

California Sales Tax Small Business Guide Truic

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

California Sales Tax Rates By City County 2022

California Taxpayers Association California Tax Facts

Understanding California S Sales Tax